Washington, July 9, 2024 — The Federal Reserve System, the tremendous banking device of the usa, delivered a huge adjustment to the federal budget rate following its policy assembly on Wednesday. This selection has sent ripples during the economic markets, especially affecting the commodity markets.

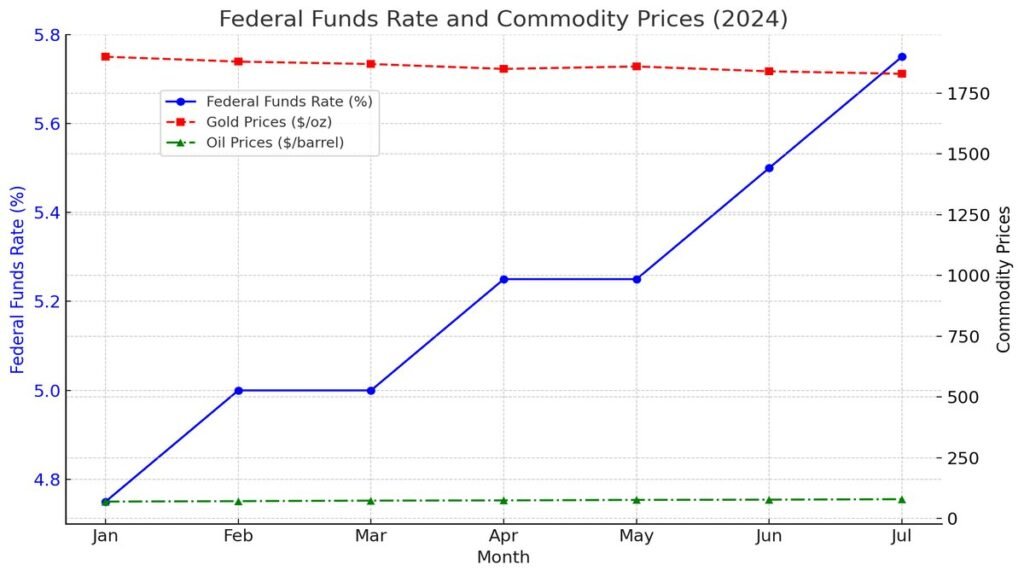

The Federal Open Market Committee (FOMC) decided to raise the federal price range charge with the useful resource of 25 basis points, bringing the aim range to five.25% – 5.50%. This bypass marks the fourth boom this year, geared in the direction of stopping continual inflationary pressures within the economic device.

Impact on Commodity Markets

The commodity markets reacted sharply to the fee hike. Gold expenses fell with the useful resource of two% to $1,850 per ounce because the more potent dollar, as a result of better hobby prices, made the valuable metal extra steeply-priced for distant places customers. Conversely, crude oil prices saw a slight boom, with Brent crude growing via 1.5% to $80 regular with barrel. Analysts feature this to expectancies of tighter financial coverage slowing down economic boom and therefore lowering future oil name for.

Agricultural commodities had been not spared both. Corn and soybean futures skilled a decline, with corn down with the resource of 1.Eight% and soybeans through 1.Three%. Higher borrowing costs are predicted to increase production costs for farmers, which could subsequently motive decreased supply and better prices inside the long time.

Broader Economic Implications

Federal Reserve Chair Jerome Powell, in a press conference following the assembly, emphasized the want for endured vigilance in opposition to inflation. “While we have made progress, inflation remains expanded. This fee adjustment is a important step to ensure we stay at the direction to our 2% inflation aim,” Powell said.

The Fed’s choice comes amid a backdrop of blended economic signals. Recent information confirmed a sturdy process marketplace with unemployment at a near-report low of three.6%, but also highlighted chronic inflation, with the Consumer Price Index (CPI) growing 4.1% 12 months-over-year in June, properly above the Fed’s goal.

Financial markets have been initially volatile following the declaration. The S and P 500 dipped zero.Five% earlier than stabilizing, as investors digested the results of better borrowing expenses on employer profits and financial increase.

Global Repercussions

The Federal Reserve’s moves are also being cautiously watched globally. Higher U.S. Interest costs generally tend to attract capital flows into the greenback, placing stress on rising marketplace economies that rely on dollar-denominated debt. Several primary banks round the area may be brought about to modify their private economic regulations in reaction to hold overseas cash stability and manage inflation.

Outlook

Economists are divided on the destiny trajectory of hobby costs. Some recollect that the Fed can also need to preserve elevating costs if inflation does now not show first-rate signs and symptoms of easing, while others argue that the monetary gadget might also already be susceptible to a slowdown, which could necessitate a pause or perhaps a reversal in coverage.

As the Federal Reserve navigates those difficult waters, all eyes will continue to be on imminent economic statistics and the essential monetary organization’s subsequent moves. The sensitive stability among curbing inflation and maintaining economic boom remains the Fed’s primary cognizance.